“Nobody wants to be in Banking, everyone wants to be in FinTech”, that’s how Lionel Barber (editor @ Financial Times) summed up the discussions from the World Economic Forum annual meeting in Davos.

Starting from this point of view, it’s pretty obvious that the banks are under huge pressure today.

And the ones not accepting/ embracing technology, will damage the “1 to 1” relationship they have with the customers.

And that’s the foundation of o good partnership, right?

“Just 10 percent of business leaders said their banks were in the state of “being digital,” while another 22 percent said they were “becoming digital”, shows a recent Deloitte Dbrief published in WSJ

How did the Banks get here/ To do list:

- The banks lost customers’ trust: this relation was and will always remain about trust. 2008 was a key point in FinTech’s development and maybe, without the crisis, banks wouldn’t be so pressured to adopt technology.

- People have higher expectations: and that’s the normality, because consumers are now used to a better experience in lots of other domains. By comparison, until a couple of years ago, financial services looked and felt outdated and restricted.

- Here come the millennials: meaning consumers that have to be approached in a totally different way. The banks must understand that money/ especially cash is a concept in a continuous change.

“This next generation coming up will inherit the global economy. We’ll place it on their shoulders. We owe it to them to set them up to financial success“, Adam Carroll/ Founder&Author of National Financial Educators

- Read on this topic: Educating the next generation in “a world where money is an illusion” has very large consequences

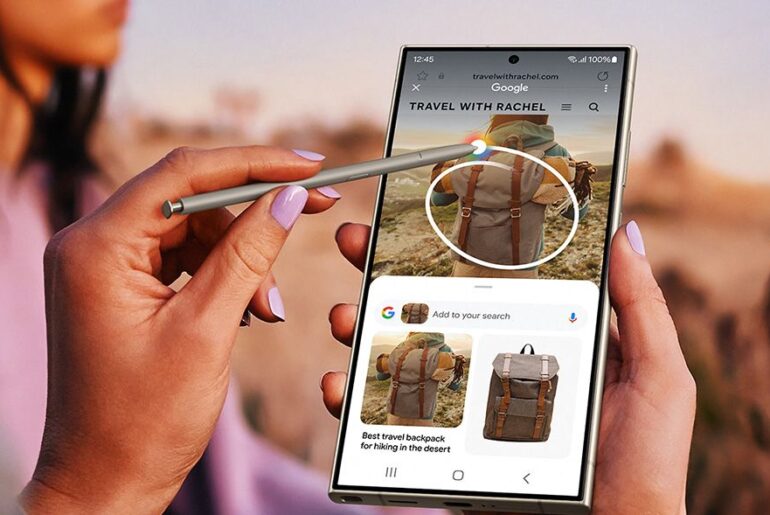

- The rise of the mobile: consumers’ expectations of how and where they can do their banking have changed. Today, all you need in order to make a transaction is a smartphone and, of course, a bank that keeps up with technology

- The rights of the consumer: with or without technology, consumer protection must always be the priority.

“Banks remain cybercriminals’ biggest target. Marketing and IT leaders can limit their ability to hack and harvest data by segregating sensitive data and leveraging leading-class encryption technology”, according to WSJ

Due to its major impact in our lives, FinTech will be a hot topic inside iCEE.fest 2017 (June 15&16).

Don’t miss the best price available and join the place to be for the CEE digital industry this June.